child tax credit portal not working

That means if a five-year-old turns six in on or before December 31 2021 the parents will receive a total Child Tax Credit of 3000 for the year not 3600. The problem is if you want to claim a refundable tax credit you will need to.

Once you reach the homepage you will scroll down and click on Manage Advance Payments.

. You can access the CTC Update Portal here. This year americans were only required to file taxes if they. If youre curious about how much your household will get.

At first glance the steps to request a payment trace can look daunting. These payments up to 300 per month per child under age 6 and up to 250 per month per child age 6 through 17 will be paid in equal amounts and made no earlier than July 1 2021 and no later than Dec. There has been lots of hype in the news about the new 2000 Child Tax Credit.

Its called the Non-filer sign-up tool which is for people who did NOT we repeat DID NOT file their 2020 taxes which would have been done in 2021. That means that instead of receiving. Get your advance payments total and number of qualifying children in your online account.

You must report any changes to your circumstances to. I cant even get into the. Do not assume your refund will include 2000 per child for child tax credits.

Enter your information on Schedule 8812 Form. It does not work that way. The Child Tax Credit Update Portal now issues a warning in bold.

This year Americans were only required to file taxes if they. If you are not you can either still file taxes or use the Non. The child tax credit ctc is also limited to your tax liability.

If you are already receiving the maximum amount a decrease in your 2021 income. And towards the end of this post we will walk through step-by-step what you need in order to. From here you can see if you are eligible for the child tax credit and check on whether you are currently enrolled to receive money or not.

Child Tax Credit Portal Not Working How To Check Supplier Gst Status Status Tax Credits Tax Payment. Not everyone is required to file taxes. Posted by 2 months ago.

Child tax credit portal not working. The Child Tax Credit Update Portal allows you to. Child tax credit update portal not working.

The CTC is. The first monthly child tax credit check will arrive July 15. The advance payments are half of the total so the couple will receive 500 250 per dependent each month until December.

Youll need to print and mail the. I cant even get into the portal it keeps saying unavailable and doesnt have my name just TAXPAYER and the little cloud crying. That translates to 250 per month.

Your tax credits could go up down or stop if there are changes in your family or work life. Check mailed to a foreign address. Child Tax Credit portal not working.

If you sign in to the child tax credit portal and you do not see any notification displayed on the landing page that you are eligible for the credit there can be. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The Child Tax Credit provides money to support American families.

For tax year 2021 only ARPA increased the child tax credit amount to up to 3000 for each qualifying child between age 6 and. That means that instead of receiving monthly payments of. Child Tax Credit portal not working.

These people can now use the online tool to register for monthly child tax credit payments. The Child Tax Credit Update Portal now lets you opt out of receiving this years monthly child tax credit payments. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000.

Generally you can expect to receive up to 300 per qualifying child under age 6 and 250 per child ages 6 to 17. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. To reconcile advance payments on your 2021 return.

Here is some important information to understand about this years Child Tax Credit. Unfortunately some people do not yet understand that it does not mean they will automatically receive 2000 per child just for filing a tax return. You may be eligible for Child Tax Credit payments even if you have not filed taxes recently.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

What Families Need To Know About The Ctc In 2022 Clasp

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

What To Do If You Still Haven T Received Your Child Tax Credit Payment Forbes Advisor

White House Unveils Updated Child Tax Credit Portal For Eligible Families

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

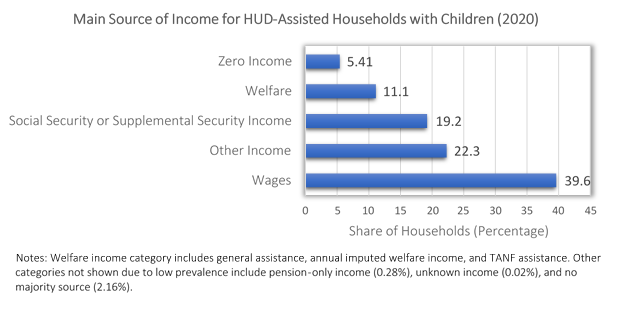

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Did Your Advance Child Tax Credit Payment End Or Change Tas

Missing A Child Tax Credit Payment Here S How To Track It Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Didn T Get Your Child Tax Credit Here S How To Track It Down Gobankingrates

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User